The traditional energy market headaches

Individual trader challenges:

High volatility in spot prices makes it challenging to predict and manage costs effectively. Not to mention the low liquidity in the futures markets restricting trading opportunities and limiting flexibility. Additionally, rising collateral requirements strain financial resources, making it difficult to maintain trading positions.

The energy market challenges

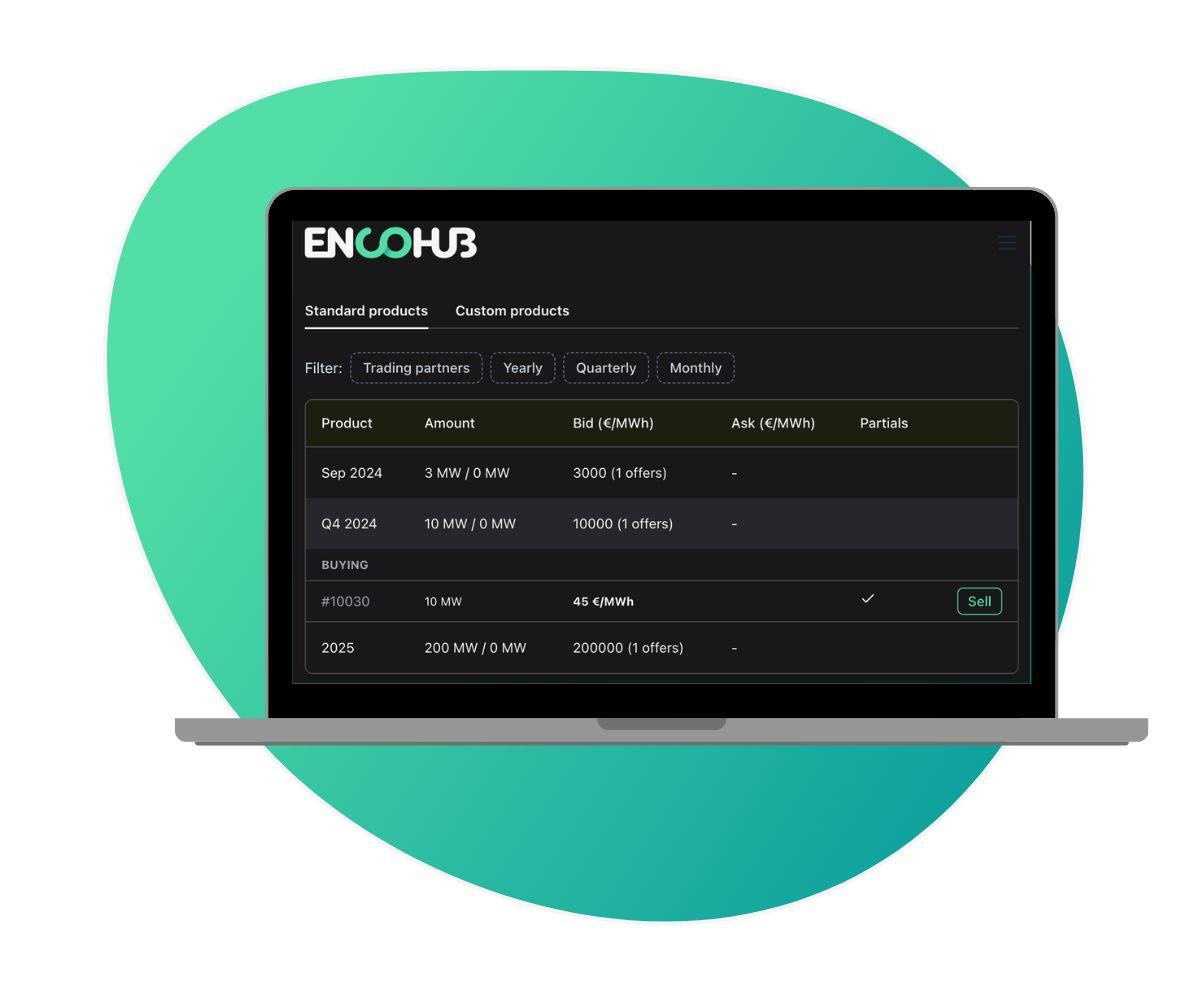

The tightened collateral requirements, rising even to hundreds of millions of euros, have driven companies operating in the wholesale electricity market into difficulties and even bankruptcy. This has led to a mass exodus of market participants to outside the exchanges, where on the other hand finding reliable trading partners and the lack of price transparency are seen challenging.