Striking the Balance between Risks and Rewards in Power Markets

Balancing Risks and Rewards: Energy Price Risk Management in Power Markets

In recent years, energy price risk management in the power market has undergone significant turmoil, presenting new challenges and opportunities for electricity market participants. As the dynamics of power trade continue to evolve, striking the right balance between risks and rewards has become more crucial than ever. In this article, we will explore the importance of choosing the right strategies to effectively manage electricity price risks in today’s ever-changing electricity market landscape.

One of the fundamental truths of the power market is that there is no one-size-fits-all solution when it comes to electricity price risk management. Each instrument and channel comes with its own set of strengths and weaknesses, and understanding how to leverage them effectively is key to success. Whether you are an electricity producer, a retailer, or a high-volume electricity consumer, your approach to risk management will vary depending on your role in the marketplace, your production and demand profiles, as well as your funding and ownership structure.

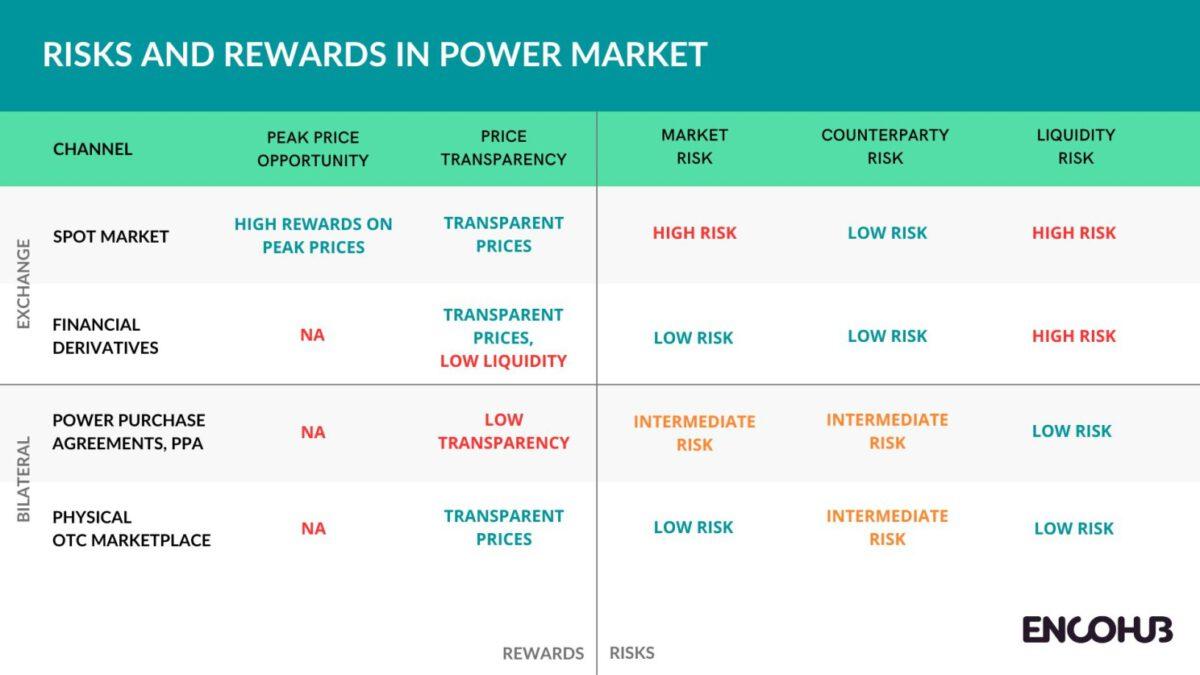

Each channel offers its own potential rewards, but these must be weighed against the associated risks.

Comparison of Trade Channels and Associated Risks and Rewards

Take, for example, the difference between a typical electricity producer that relies on predictable and low-cost production methods versus one that utilizes renewable sources, such as wind or solar. The former may have greater flexibility to adjust production levels to meet peak demand without incurring significant additional costs, while the latter may face challenges related to intermittency and variability in output. Hence, the need for balancing electricity power price risks may vary a lot between different types of market participants.

Furthermore, the ability to effectively manage risks in the electricity power market often depends on the resources and infrastructure available to market participants. Some organizations have dedicated teams and sophisticated risk management systems in place, while others may need to rely on external service providers for support.

When evaluating different channels for electricity power trade, it’s essential to consider both the opportunities and various risks involved, including market risk, counterparty risk, and liquidity risk. Each channel offers its own potential rewards, but these must be weighed against the associated risks.

Trade Channels: Risks and Rewards

- The spot market can offer the potential for high returns, but it also exposes participants fully to market volatility. Still, many market player currently utilizes the spot market as their primary channel for physical trade because of high liquidity and straightforward access to the physical electricity market.

- Financial derivatives such as futures and forwards offer opportunities to hedge against price fluctuations but require a deep understanding of market dynamics and may involve complex financial instruments. Also, the daily operations related to cash settled financial derivatives may cause additional troubles and costs.

- Long-term power purchase agreements (PPA) provide stability and predictability but may limit flexibility and expose parties to credit risk if counterparties fail to fulfill their obligations. Also, renewable energy production traded with PPA’s may lead to contracts where the buyer will be exposed to high profile risk (Pay-as-Produced).

- Physical OTC marketplace combines the best of both worlds, the price transparency from the exchange world along with minimal or reasonable collateral requirements inherent in bilateral trade of physical settled power products. The counterparty risk can be effectively managed through engaging in relatively small transactions with multiple trusted parties.

In conclusion, navigating the power market requires careful consideration of the balance between risks and rewards. By understanding the strengths and weaknesses of different strategies and channels, market participants can make informed decisions to optimize their risk-return profiles and thrive in today’s dynamic energy price risk management landscape.

Jan Landén, CEO, EnCoHub Oy